Integration with Margin Pools

Glow Finance’s Margin Pools serve as the backbone for managing liquidity within margin accounts. These pools provide a dynamic framework that adjusts interest rates based on utilization, ensuring an optimized environment for both lenders and borrowers.

What Are Margin Pools?

Margin Pools are liquidity reserves where users deposit assets to facilitate borrowing and leveraging activities. The pools dynamically adjust interest rates according to supply and demand, promoting an efficient and competitive lending ecosystem. These pools operate with dual goals:

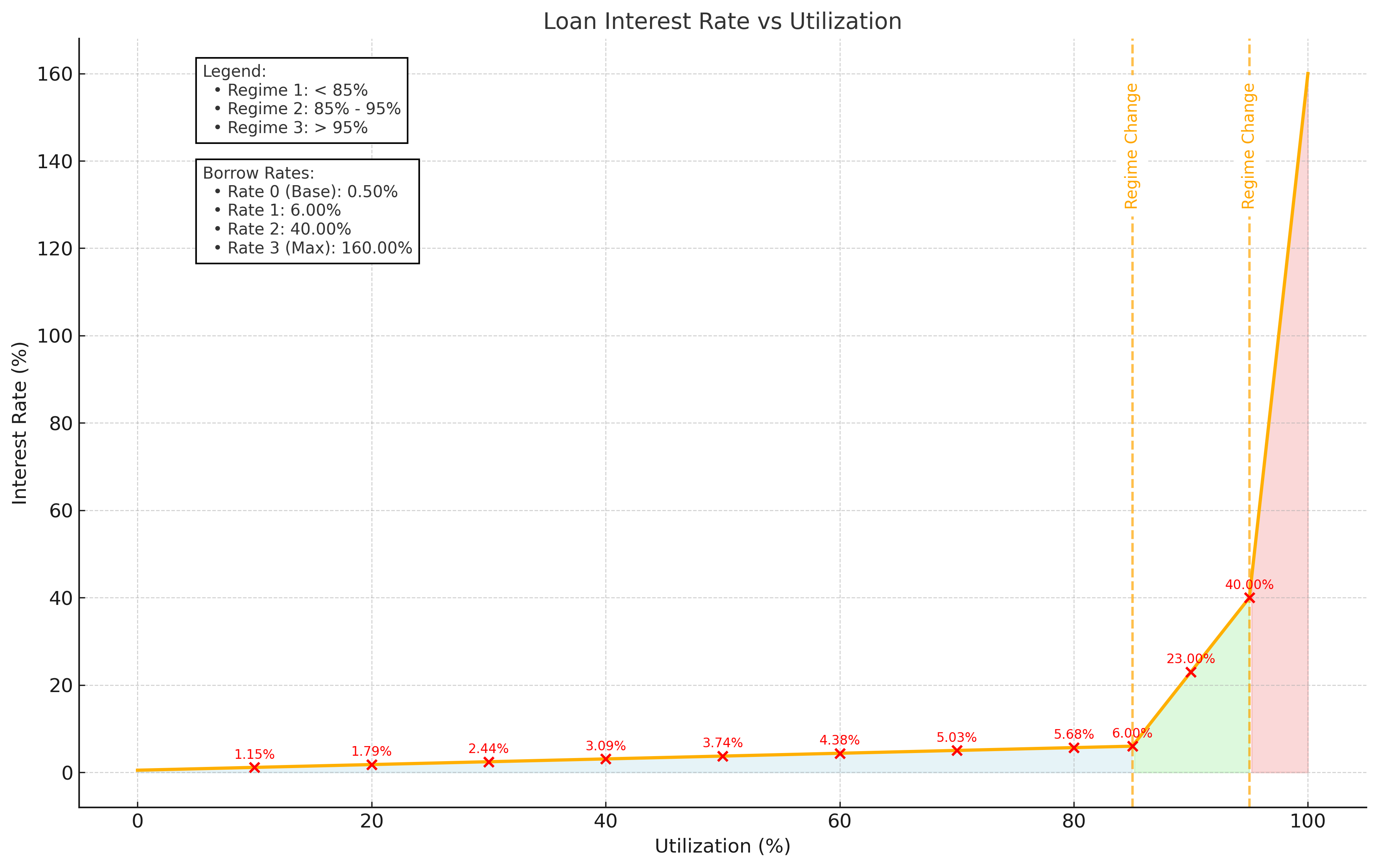

- Providing Liquidity: Margin Pools aim to provide borrowers with access to funds while balancing the availability of assets for withdrawal by lenders. However, it is important to note that liquidity (the ability to withdraw fully) is not guaranteed at all times, due to the case where all lender deposits in a pool are fully borrowed by users of the protocol. In scenarios of high utilization—where most assets in the pool are lent out—borrowers may temporarily face restricted access to funds, and lenders may not be able to withdraw fully. The utilization and interest rate curve for the protocol has been designed carefully such that during these times, lending rates for the highly utilized asset will offer rates well above 100% APY to lenders; this aims to rapidly attract new capital to the platform and thus solving the lack of liquidity available to withdraw for lenders. Of course, lenders may also choose to simply do nothing, since they will earn such a high lending rate at these times.

To mitigate this possibility for lenders who do want to withdraw, Glow utilizes a utilization rate interest curve. As the utilization ratio of an asset pool approaches 100%, the lending rates for that pool increase sharply. This mechanism is designed to quickly attract additional liquidity to the pool, providing more accessible funds for borrowing and withdrawals, while simultaneously incentivizing repayments from borrowers.

- Yield Generation: Lenders earn interest based on their contributions and the pool’s utilization rate.

Key Features

- Dynamic Interest Rates - Utilization and Rates:

- A pool’s health and usability are primarily determined by its utilization rate. Interest rates are calculated based on utilization rate — the ratio of borrowed liquidity to total available liquidity. High utilization signifies that most of the pool’s liquidity is borrowed, triggering higher interest rates to attract new deposits. Conversely, low utilization leads to lower interest rates in order to incentivize inexpensive borrowing.

- Higher utilization increases interest rates, incentivizing new deposits and balancing the pool’s liquidity.

- Dual Roles for Users:

- Lenders: Deposit assets into Margin Pools and earn yield, benefiting from competitive rates while increasing account collateral in case borrowing is desired.

- Borrowers: Access liquidity by borrowing against their deposited collateral, leveraging their positions for strategic investments.

- Deposit and Borrow Limits: Glow Finance enforces global limits on the amount users can deposit and borrow to ensure the platform's stability and liquidity management. These limits are designed to safeguard the protocol from overexposure and maintain a sustainable ecosystem for all users, and will be raised over time.

- Risk Management: The system ensures sufficient liquidity is maintained by managing interest rates and imposing collateral requirements for borrowers. Additionally, there is a safety buffer feature in place that caps pool utilization at 95%. In the rare event where bad debt occurs, losses will be socialized across lenders. This approach ensures that no single user bears the brunt of protocol-level risks, aligning Glow Finance with best practices in DeFi liquidity management. In the event of an unrecoverable bad debt beyond insurance, losses will be socialized across lenders. Standing protocol fees that have been earned for a particular asset pool can also be counted as a backstop/insurance fund (likely only will partially cover bad debt until fees accrue over time).

User Experience in Margin Pools

When users interact with Glow’s Margin Pools:

- They can deposit assets directly into the pools by simply depositing assets to a margin account, which increases the available liquidity.

- Users can borrow from these pools, leveraging their collateral for advanced strategies.

- Interest rates for both deposits and loans are transparently displayed in the application interface, enabling users to make informed decisions.

How Glow Enhances Margin Pools

Glow Finance simplifies and optimizes the traditional lending pool model:

- Efficient Liquidity Management: Glow's system dynamically adjusts to user behavior, maintaining liquidity availability for both deposits and withdrawals.

- Enhanced User Control: Users can monitor their positions and risks with real-time metrics and alerts.

- Simplified Access: No need for complex configurations—users deposit, borrow, and leverage seamlessly within the platform.